By Scott Pluschau

www.scottpluschau.blogspot.com

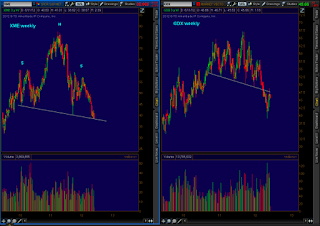

XME the Metals and Mining Exchange Traded Fund (see left hand side) is sitting on the neckline of a baleful bearish "Head and Shoulders" pattern on the weekly chart.

What kind of "fortitude" do the bulls have in metals and mining stocks if the neckline fails is the big question. I'm not interested in contributing any support here, but if you think you have got good value or a deep discount go ahead and be my guest.

GDX the Gold Miners ETF had a nice run going off the lows, but the failure to stick the landing above the prior major multipoint trendline on the weekly chart (see right hand side below) was not good news for the bulls at this time in my opinion.

Perhaps bargain hunting will cause an increase in demand to meet the supply here, but I don't have a trading methodology to take advantage of it. What I will do is gladly wait for a bullish reversal pattern at the bare minimum. I have no issues paying a much higher price in order to increase my probabilities for success.

(Click on chart to expand)

There are many ominous bearish "Head and Shoulders" patterns forming across the globe in equities. This post I did on May 13th, is worth a review here: http://scottpluschau.blogspot.com/2012/05/pluschau-omen.html

twitter/ScottPluschau

Consulting? ScottPluschau@gmail.com

Members to Scott's blog are appreciated

Comments are welcome

Source: "Heads Up" on Metals and Mining equities.: